This fact may be a relief to the number of American families and individuals as the start of 2026 nears. Inflation, skyrocketing rent, food and heating gas and electricity cost have strained the budgets of ordinary citizens. Here, the Internal Revenue Service (IRS) in the U.S. has declared a single direct deposit of $ 2,000. The very purpose of this payment is to support low and middle-income individuals and families and assist them in receiving a certain amount of finances during the first months of the year and allow them to better adjust their key expenditures.

This has been deemed to be an important step to families that are already struggling with their economic situations, every additional dollar matters. This aid can be of temporary but valuable help during the winter months when the costs are generally greater.

What is this $2,000 IRS Payment?

One should realize that this is not a tax refund, loan or advance payment of 2,000 dollars. It is a temporary, single payment, which is provided by the IRS. It is only aimed at offering a short-term financial relief which cannot be repaid or changed in the future. This payment will be calculated using information about your 2024 or 2025 tax returns.

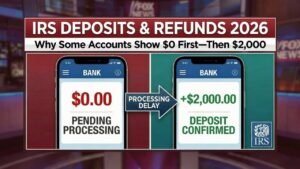

The majority of the eligible people will receive this sum through direct deposit with an estimated date to be January 12, 2026. Individuals whose bank details are not with them in the records of IRS will receive the payment in the form of paper money sent by mail to their address that may take up to the end of January. The government wants to have this money to people as soon as they can so that they can spend it in their basic needs.

Who is Eligible for this Payment?

The IRS will also utilize the latest tax return in order to establish your eligibility to this relief payment. This shall consider aspects like your income, residency and your history in filing tax returns. You must have done either of the following things to qualify: you must have submitted your 2024 tax return, or, in the case you are not obliged to pay taxes, you must have claimed the non-filer option.

Moreover, you should possess a valid Social Security number and should have been living in United States at least six months in the year 2025. It also has some income limits though IRS has made it clear that those who are slightly above the limits could also get a reduced payment. Additional assistance can also be provided to families with dependents, which raises the amount of relief.

When and How Will the Payment Be Received?

This amount will not be paid in one go but in a number of installments. People who already submitted their tax returns 2024 and have the correct and current information on direct deposit are most likely to get their payments first. The payment, to other qualified individuals, will be handed out in later stages.

Users that do not receive direct deposit or have not submitted their bank details to the IRS will have their payment through a paper check by the end of January 2026. Checks that are mailed however might be delayed and it is important to keep your information updated.

What Should You Do to Avoid Delays?

The good part is that the majority of the population will not have to apply separately to receive this in the form of payment. The payment will automatically be issued by the IRS on condition that you supplied the correct information. Nevertheless, you can do certain things to prevent any delays and problems.

In case you have a new address or bank account, it is very important to update your details using online portal of IRS. Moreover, it is reasonable that it is important to file your tax return in time and properly since this data will be used to define your eligibility. Any minor negligence may cause hold-ups or failure to make payments.

Federal Deposit Searches Spike Nationwide — Why the $725 Monthly Program Is Trending in January 2026

A Much-Needed Financial Boost in Early 2026

On the whole, this IRS relief payment of 2,000 dollars may be a major pick-up of the American families at the beginning of 2026. It could be to pay the rent or meet the daily groceries or to pay the bills which are essential such as electricity, gas and heating- the objective is to reduce some of the financial burden.

Although not a long-term answer, it is definitely a good move during hard economic times. Alertness, keeping your records close at hand and keeping an eye on the IRS announcements will make sure whether you are getting this payment or not.

FAQs

Q1. Is the $2,000 IRS payment a tax refund?

No, it is a one-time relief payment and not a tax refund, loan, or advance.

Q2. When will eligible people receive the payment?

Most direct deposits are expected to begin around January 12, 2026.

Q3. Who qualifies for the $2,000 payment?

Eligibility is based on income, tax filing status, residency, and information from recent tax returns.

Q4. How will the money be sent?

Payments will be sent by direct deposit or by paper check if bank details are not on file.

Q5. Do I need to apply to receive this payment?

No, the payment will be sent automatically if your IRS information is up to date.